The market for private 4G / 5G networks is growing larger and more complex, both in terms of deployment scenarios and the regulatory / compliance oversight that will be required.

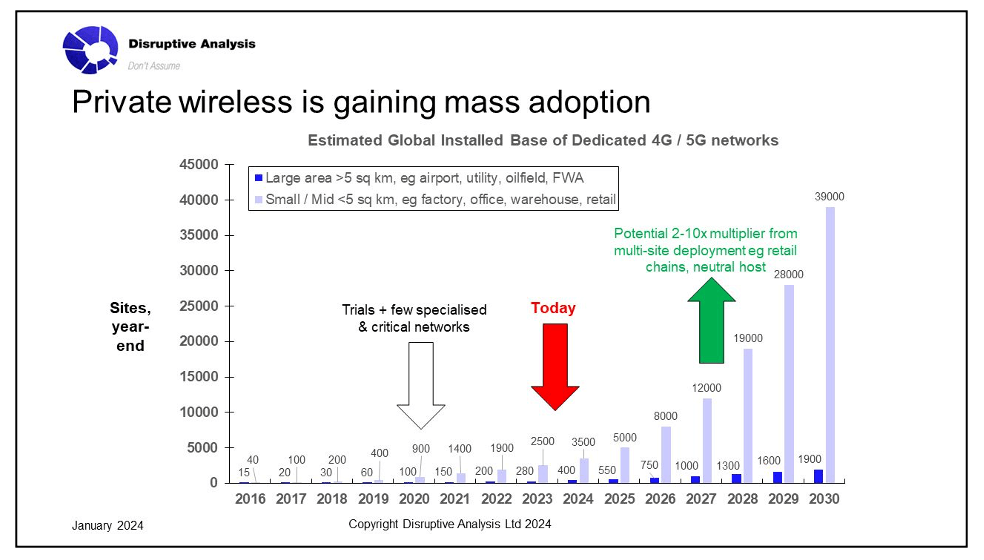

While there are many ways to count private networks, there seems to be little doubt that they will become much more common at various scales in the next few years.[1] Numbers will rise from low thousands to tens of thousands—maybe 100,000 or more, depending on market and technology trends.

This increase is being driven by the availability of suitable local spectrum bands—based on various sharing mechanisms developed by regulators, together with more options for deployment and operation. Numerous suppliers are trying to make private 4G or 5G networks “as easy as Wi-Fi” to obtain and run.

There is also a proliferating range of delivery channels, from direct setup by more skilled enterprises to a range of specialized systems integrators and vertical-focused managed-service providers. In addition, traditional mobile network operators (MNOs) are also present in the market for enterprise 5G, either through providing similar isolated networks or various extensions or slices of their main national infrastructure, using their exclusive licensed frequencies.

Nearby / overlapping scenarios will evolve next

While much of the discussion of private cellular considers individual, isolated sites and specific companies, the real world will have to deal with more overlap. Just as a given place may have a dozen or more separate Wi-Fi networks visible, we can also expect a growing number to have multiple private cellular implementations in relatively close proximity.

These will perhaps share the same or adjacent spectrum bands. The network owners will want to avoid interference to ensure that business-critical mobile networks are not disrupted and prevent contravening their license terms. There could also be challenges outside the radio domain, for instance, if different networks share common mobile network codes for international mobile subscriber identities (IMSIs) or subscriber identity modules (SIMs).

Some of the emerging scenarios for multiple overlapping or nearby networks include:

- Airports, where there may be separate private networks for the terminals, the ramp area, and specific third-party structures such as airline hangars, fuel depots, or nearby warehouses and hotels.

- Ports, which have well-known needs for connecting dockside cranes and container-carrying vehicles, also often have multiple other major tenants on-site that may have private networks. These can include oil terminals, rail facilities, vehicle facilities, and even private 4G/5G onboard some vessels.

- Business and industrial parks, which may have multiple tenants expecting to run their own networks independently, as well as campus-wide networks run by the site owners or local authorities.

- Military settings, which may have private networks run by multiple branches of the defense forces, as well as independent systems used by suppliers, contractors, and international alliance partners. There may also be networks onboard ships or aircraft, as well as small field-operation systems and ongoing tests.

- Urban areas, which may have private networks run by a local smart-city authority, as well as private networks used in diverse sectors such as retail, hospitality, sports events, health, education, and transport. There is also a trend towards using private networks as the basis for neutral-host in-building coverage, which is small today but could eventually approach Wi-Fi-type levels of utilization.

- Major events, which may have the venue itself operating its own local wireless infrastructure for security and operations, multiple temporary networks used by the broadcasters, plus networks used by sports teams and other on-site groups such as public safety agencies.

In the near term, such issues might be considered a “high-quality problem” as they are symptoms of a growing market for private wireless. However, as they become more widespread, there will likely be calls for more measures to ensure isolation—and also to work out ways to squeeze in more networks to a given geographic area.

Evolving roles for sensing for private networks

We are still in the early stages of regulators providing local spectrum for private networks. The rules and mechanisms vary widely by country, with automated systems such as the Spectrum Access System (SAS) platforms for the US Citizens Broadband Radio Service (CBRS) bands and more manual administrative arrangements for the UK’s Shared Access Licenses and Germany’s Campus Networks.

In most cases, the private network bands are in the 2–5GHz mid-band range, such as 3.8–4.2GHz, but there are also examples of sub-1GHz allocations for sectors such as utilities and energy, as well as a few markets with 24–28GHz mmWave private networks.

The power and separation rules for these allocations have largely been conservative, but as demand and usage increase, we can expect three new trends:

- Regulators will want to ensure radio emissions conform with the specific power limits and permitted coverage zones for licensees.

- Studies will suggest ways to improve the number and density of nearby networks, either through mutual coordination between neighbors or licenses that specify antenna directionality rather than assuming isotropic signals. Many of the current visions for private cellular have a “first come, first served” basis, but that may change as demand increases and latecomers lobby for equitable access.

- Private network operators will want to monitor for accidental or deliberate interference. They may also have compliance needs to ensure they are being “good neighbors” rather than having a surprise visit from enforcement officials.

There are already signs of these trends in UK regulator Ofcom’s review of its shared access license framework,[1] which states: “We propose to do this by relaxing certain coordination assumptions to better match real-world conditions, and by allowing additional user input in coordination decisions.”

But for all three of these themes, a key enabler for ensuring adequate isolation of private 5G networks will be suitable spectrum-sensing equipment, perhaps in combination with databases or, eventually, digital twins of the RF environment.

Conclusion

There will likely be a mix of one-off testing of spectrum usage and ongoing monitoring efforts. This will probably align with the critical nature of specific sites and networks and the risks of overlap with neighbors. Currently, limited attention is paid to these issues, as the focus has been on initial adoption and growing the market. But thinking ahead about this next-phase issue seems wise, especially for the most crowded potential locations.

[1] https://www.ofcom.org.uk/consultations-and-statements/category-1/consultation-supporting-increased-use-of-shared-spectrum

[1] https://www.linkedin.com/feed/update/urn:li:activity:7150408960473255937/

Brochure

RFeye Mission Manager

Schedule & automate spectrum monitoring in multi-user environments

Dean Bubley

Dean Bubley, founder of Disruptive Analysis, writes guest posts for CRFS. He is an independent analyst and advisor to the wireless and telecoms industry and has covered the evolution of private cellular networks since 2001.